Europe’s ongoing energy crisis and elevated gas price has led to significant production cuts of key chemicals which could be a potential opportunity for Indian chemical manufacturers looking to expand their footprint in the international markets. The reduction in Russian gas supplies has escalated electricity costs for European countries, thereby, impacting the production of energy-intensive chemicals like ammonia, methanol, melamine, etc. In some cases, production has been cut by more than 50 percent. This has created a huge supply crunch for global chemical importers who heavily relied on European chemical manufacturers for their supply sources paving a way for their Indian counterparts to diversify their supply chain operations.

Although the shortage of gas has prompted talks of crippling industry but for most energy-intensive sectors, things have become so worse owing to the rising costs that they were forced to close down.

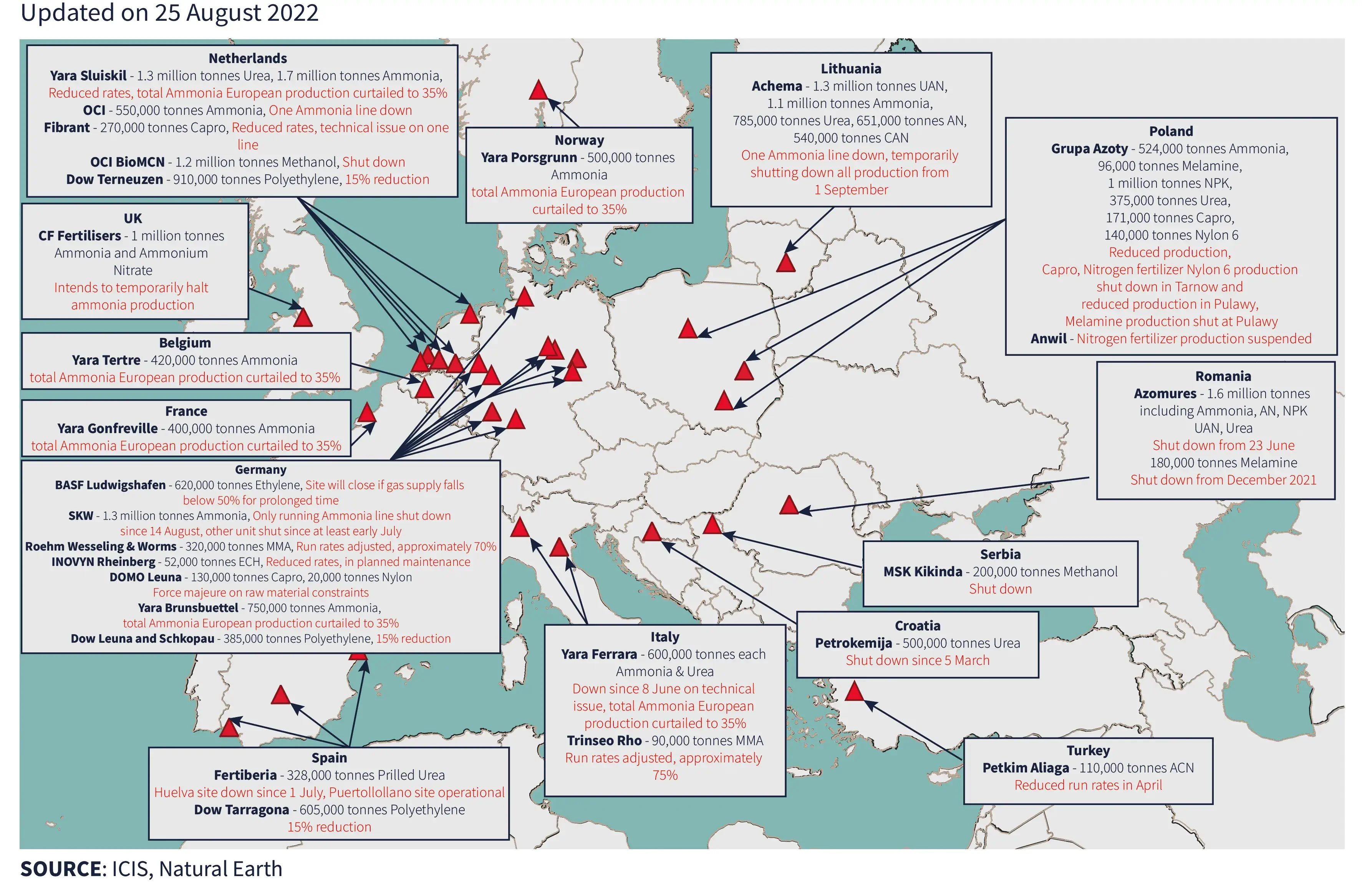

Plethora of shut-down

The closures could cause long-term damage to Europe’s industrial base. The most energy-intensive industries in Germany are hit hard by unsustainable costs as energy accounts for 26% of the metallurgy industry costs; 19% of basic chemical production; 18% of glass manufacture; 17% for paper; and 15% of construction materials. Most of Europe’s aluminium smelters have been badly affected by the power crisis. The EU has witnessed temporary capacity reduction of 650,000 tonnes of primary aluminium. Some of Europe’s biggest chemical plants have also been closed.

The German chemicals powerhouse BASF demonstrated that risk could arise due to gas shortage in Europe which will be compensated by higher planned capacity utilisation at sites outside of Europe.

CRU Group estimates that Europe has lost half of its ammonia capacity, and 33 percent of nitrogen fertilizer operation which is huge since Europe contributes to roughly 20% of total global ammonia production.

Rival ammonia makers Yara and CF Industries recently concluded that they were also slashing ammonia production in Europe due to a hike in gas prices.

One of Europe’s biggest fertiliser producers, Polish chemicals group Azoty and its listed unit Pulawy, has suspended production of nitrogen fertilisers and ammonia, which is also the case with Polish fertiliser maker, Anwil, owned by energy giant PKN Orlen.

The rising gas prices have significantly disrupted operations of the Romanian fertiliser producer Azomures.

Soaring gas prices hit Europe fertilizers, chemicals

Impact on European economy

Impact on European economy

The war with Russia is weighing heavily on Europe’s economy as fears of a Europe-wide deep recession build. Runaway inflation is pushing growth down as central banks across the region aggressively increase rates to regain control of prices. The significant monthly declines posted by the major economies is a sign that Europe’s energy crisis is significantly taking its toll on the industry.

A boon for Indian manufacturers

India has shown immense resilience against the global energy crisis & has taken commendable measures to control the volatility of global gas and crude oil prices. There has been a significant rise in inflation in gasoline price by almost 40% during the third fiscal in most of the developed countries while gasoline price in India has reduced by 2.12%.

Ammonia is used to produce nitric acid, ammonium nitrate and due to the higher production cost of nitric acid, it has increased by $200 per tonne to around $600 to $800 per tonne. Aarti Industries uses nitric acid as raw material and to shield themselves they announced setting up a nitric acid plant. In terms of producers, Deepak Fertilisers, GSFC and GNFC are the key nitric acid manufacturers in the country. Chemical plants like melamine, caprolactam, methanol are running at lower capacity in Europe and prices are at a record high which gives their Indian counterparts particularly caustic soda manufacturers in India an added advantage.

Since European manufacturers are facing huge challenges owing to the rising gas prices Elchemy concludes that Indian chemical manufacturers can largely ease the pain caused by the energy crisis and and support and act as a strong procurement arm to chemical importers heavily dependent on European manufacturers for their sourcing requirements.